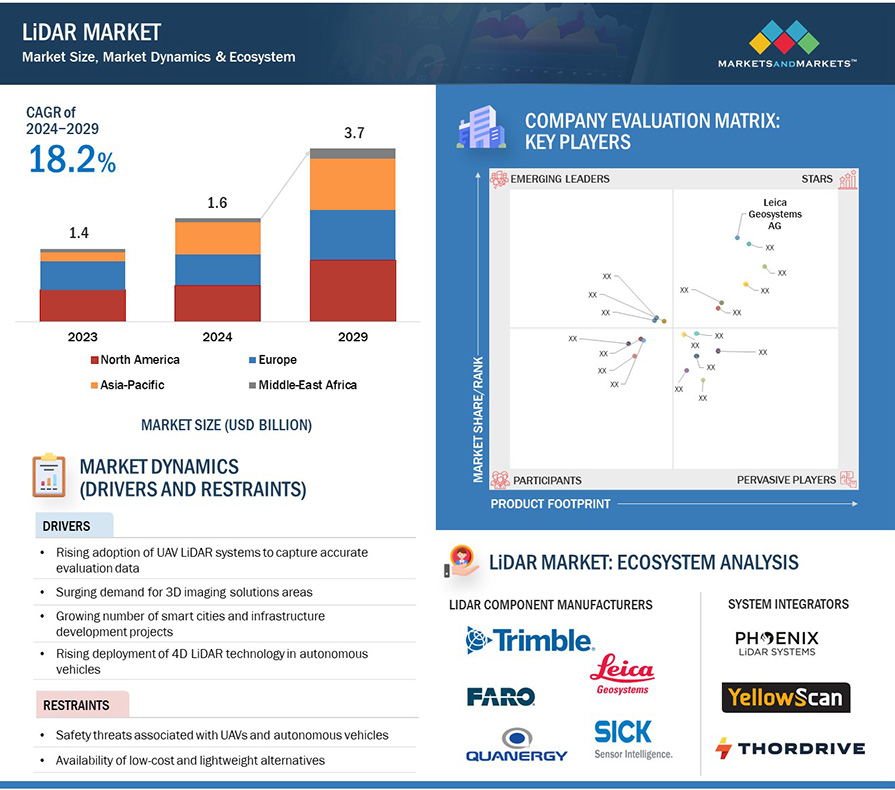

[294 Pages Report] The Global LiDAR market size was valued at USD 1.4 billion in 2023 and is estimated to reach USD 3.7 billion by 2029, registering a CAGR of 18.2% during the forecast period.

The growth of the LiDAR market share is driven by surge in the demand for 3D imagery in application areas, rise in the development of smart cities and infrastructure projects, emergence of 4D LiDAR, rising adoption of LiDAR systems in UAVs.

LiDAR Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

LiDAR technology is crucial in various smart city planning, development, and management aspects. This technology is used in urban planning to create highly detailed 3D maps of cityscapes. This information helps city planners visualize existing structures, plan new developments, and optimize land use. It monitors critical infrastructure, such as bridges, roads, and buildings. It enables the creation of accurate 3D models to assess structural integrity and identify maintenance needs.

Smart cities leverage LiDAR for disaster response and resilience planning. The technology enables the creation of detailed terrain models, which can be crucial for assessing the impact of natural disasters and planning emergency responses. LiDAR supports environmental monitoring initiatives in smart cities by providing accurate 3D data for mapping green spaces, tracking vegetation health, and assessing air quality. This information aids in sustainable urban development.

Additionally, LiDAR technology contributes to the development of smart grids by providing detailed 3D data for assessing terrain and planning the placement of utility infrastructure. This supports the efficient distribution of energy. The demand for LiDAR in smart city applications is likely to continue growing as urbanization and the development of intelligent infrastructure become more prevalent. As cities strive to become more efficient, sustainable, and technologically advanced, LiDAR’s ability to provide precise 3D data becomes increasingly valuable in supporting these initiatives.

In January 2022, Quanergy Systems, Inc., a leading provider of OPA-based solid-state LiDAR sensors and smart 3D solutions for automotive and IoT, showcased its advanced 3D IoT LiDAR solutions and technologies for smart cities at CES 2022 in Las Vegas. Quanergy’s solutions included smart mobility, retail flow management analytics, building occupancy management, and perimeter intrusion detection.

The cost of LiDAR (Light Detection and Ranging) systems is a significant restraint for the LiDAR market. Several factors contribute to the high costs, and these challenges can limit the widespread adoption of LiDAR technology across various industries. The intricate design and precision required for manufacturing LiDAR sensors contribute to high production costs. The components, such as lasers, detectors, and scanning mechanisms, often involve advanced technology and manufacturing processes, adding to the overall cost.

LiDAR systems employ complex technologies to generate accurate 3D maps or images. The integration of various components, such as laser emitters, receivers, and scanning mechanisms, adds to the complexity of the systems, making them more expensive to produce. While there is a demand for smaller and lighter LiDAR systems, achieving miniaturization without compromising performance can be challenging. Developing compact and lightweight

LiDAR devices often require specialized components and manufacturing techniques, increasing costs. High-precision LiDAR systems with exceptional accuracy are crucial for applications, including autonomous vehicles, where safety is paramount. Meeting stringent quality and accuracy requirements involves additional engineering, testing, and calibration processes, increasing costs. Integrating LiDAR systems into existing products or platforms, such as autonomous vehicles or drones, can involve additional costs for adaptation and testing to ensure seamless functionality within the broader system.

Improvements in sensor technologies are leading to the development of advanced geospatial solutions, especially for mobile mapping and machine control, consequently improving workflows, productivity, and project outcomes. Currently, sensors have the potential to bring together multiple sensor types or technologies to advance geospatial solutions in the areas of cost, performance, availability, and reliability. For LiDAR users, combining data from different types of sensors into one solution can generate more valuable data from missions, improving productivity and expanding services. The fusion of data from sensors and cameras of LiDAR systems is expected to offer a broader scope for mapping, automotive, and

Miniaturizing LiDAR systems is a significant challenge, especially when size, weight, and power constraints are critical. These systems include various components, including lasers, detectors, and scanning mechanisms, which must be made smaller without compromising their performance. Achieving a compact size while maintaining the necessary precision is a complex engineering task.

Power consumption must be reduced without sacrificing performance to make LiDAR sensors small enough for portable and battery-powered applications. However, this is a delicate balance. Shrinking the size of LiDAR sensors can limit the space available for optical components, which can affect the field of view, range, and resolution of the system. Innovative optical design solutions are required to address this challenge. Integrating miniaturized LiDAR systems into small devices, such as smartphones or drones, also requires seamless integration with other sensors, such as cameras and radar. Ensuring effective sensor fusion without compromising functionality is a complex task. However, miniaturization efforts often result in increased manufacturing complexity and the use of specialized materials, which can drive up production costs. Therefore, balancing the cost of miniaturization with market demands is a key consideration.

The corridor mapping end use application segment is expected to to account for second largest share of the LiDAR market during forecast period. Corridor mapping is used for surveying roads and railways. LiDAR generates digital terrain models (DTM) and digital surface models (DSM), which result from laser scanning, making it possible to create elevation profiles anywhere. Lidar provides highly accurate and precise 3D spatial data, allowing for detailed mapping of the corridor and its surroundings. This level of accuracy is crucial for engineering and design applications in infrastructure projects.

The aerial surveying services segment is expected to hold the largest market share during the forecast period. Aerial surveying services are widely deployed to monitor any mishap in areas, such as roads, railways, highways, and bridges. This surveying method can provide accurate results of inspecting the site and can be done using manned or unmanned aerial systems, such as drones and aircraft. Government bodies generally conduct these services. Aerial LiDAR is crucial in natural resource management, including forestry and agriculture. This system aids in assessing vegetation health, estimating biomass, and monitoring changes in land cover. Aerial LiDAR surveys provide high-precision and accurate 3D mapping of terrain and landscapes. The technology can capture detailed elevation data and create accurate topographic maps.

Short range LiDARs are expected to hold the largest share of market during the forecast period. Short-range LiDAR is used to detect objects in the 0–200 m range. Short-range LiDARs are used in manufacturing environments and industrial automation for object proximity sensing. They help detect the presence of objects in close proximity to machinery, facilitating safe and efficient operations. Short-range LiDARs are often employed in robotics, drones, and autonomous vehicles for close proximity obstacle detection and avoidance. They help ensure the safety of the system by identifying and reacting to obstacles in real-time. Due to the adoption of short-range LiDAR in applications, such as automobiles, security, and robotics, the short-range LIDAR segment is projected to lead the market.

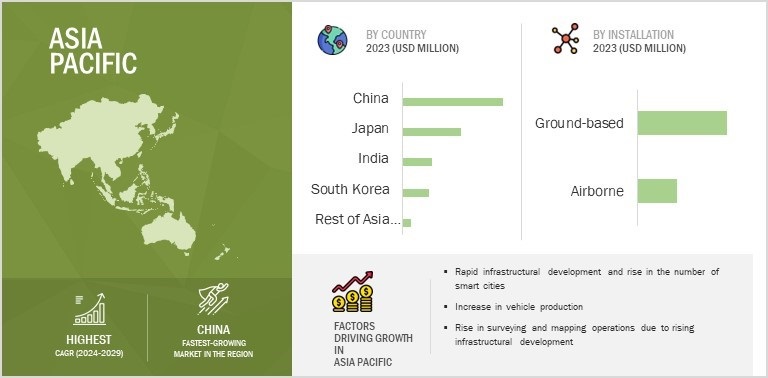

The LiDAR market, in Asia Pacific is expected to grow at the highest CAGR during the forecast period. Asia Pacific is expected to witness highest growth during the forecast period. The growth of this market can be attributed to the increase in surveying and mapping operations due to rising infrastructural development, increased focus on agricultural management, and a rise in mining activities in the region. Lack of awareness, high cost of LiDAR, and high expenses incurred in geographic surveys are limiting the momentum of this technology in the Asia Pacific.

LiDAR Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Major vendors in the LiDAR companies include Leica Geosystems AG (Sweden), Trimble Inc. (US), Teledyne Optech (Canada), FARO Technologies, Inc. (US), RIEGL Laser Measurement Systems GmbH (Austria), Sick AG (Germany), NV5 Geospatial (US), Beijing SureStar Technology Co. Ltd. (China), Ouster (Velodyne Lidar, Inc.) (US), YellowScan (France), Leishen Intelligent System Co., Ltd. (China), SABRE Advanced 3D Surveying Systems (Scotland), Hesai Technology (China), RoboSense (China).

Report Metric

Details

Market size available for years